A mutual fund is a Collective Investment Scheme (CIS) that pools money from a number of investors. The money is managed by an Asset Management Company (AMC) licensed by the Securities and Exchange Commission of Pakistan (SECP). The mutual fund raises money by selling its own shares, also known as “Units” to its investors. The money is used to purchase a portfolio of stocks, bonds, short-term money-market instruments, other securities or assets, or some combination of these investments. Each unit represents ownership in the fund and gives the investor a proportional right to dividends and capital gains the fund earns on its investments, based on the number of units they own. Majority of the income earned by the mutual fund’s portfolio is distributed among the investors. For the stakeholder’s investment protection, the regulators put in place a Trustee who provides holding services and has administrative powers for managing the property, assets, and money of the mutual fund. The trustee can be an individual person, a company or a bank appointed with the approval of the SECP. They are trusted to make decisions in the unit holder’s best interest.

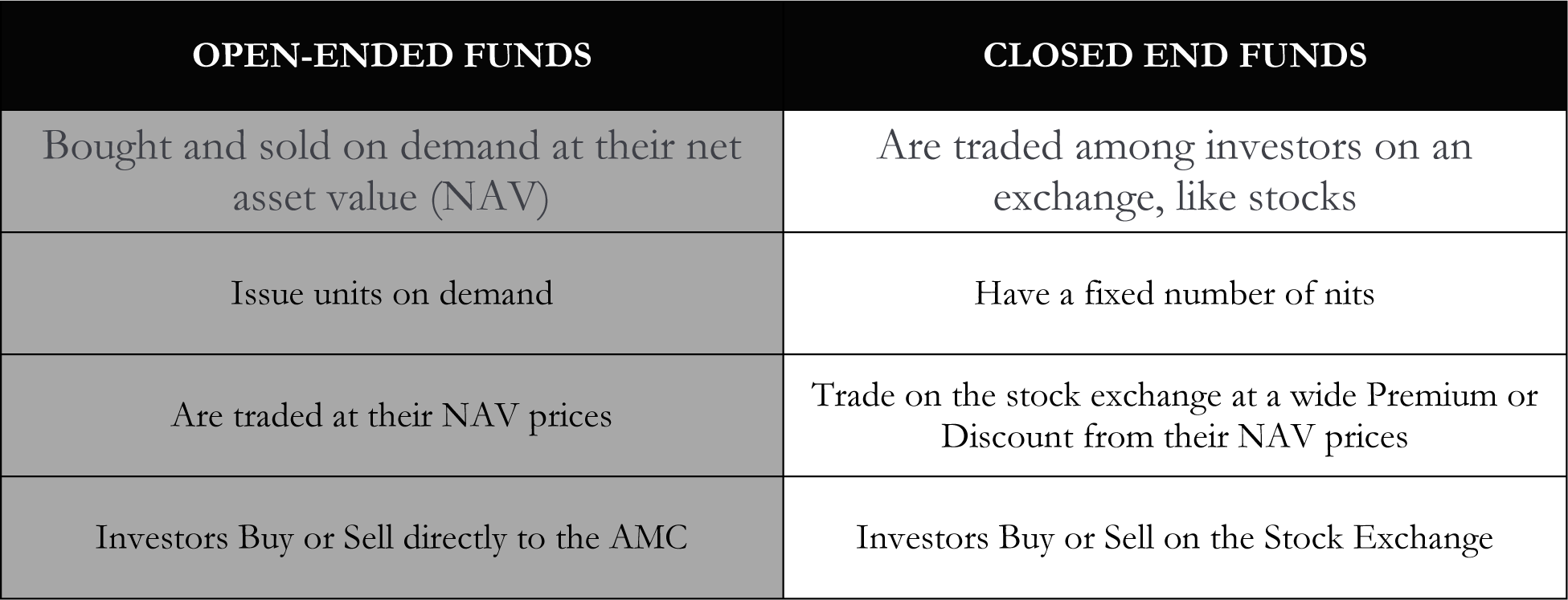

For the knowledge of our investors we have compared the two main categories of mutual funds:

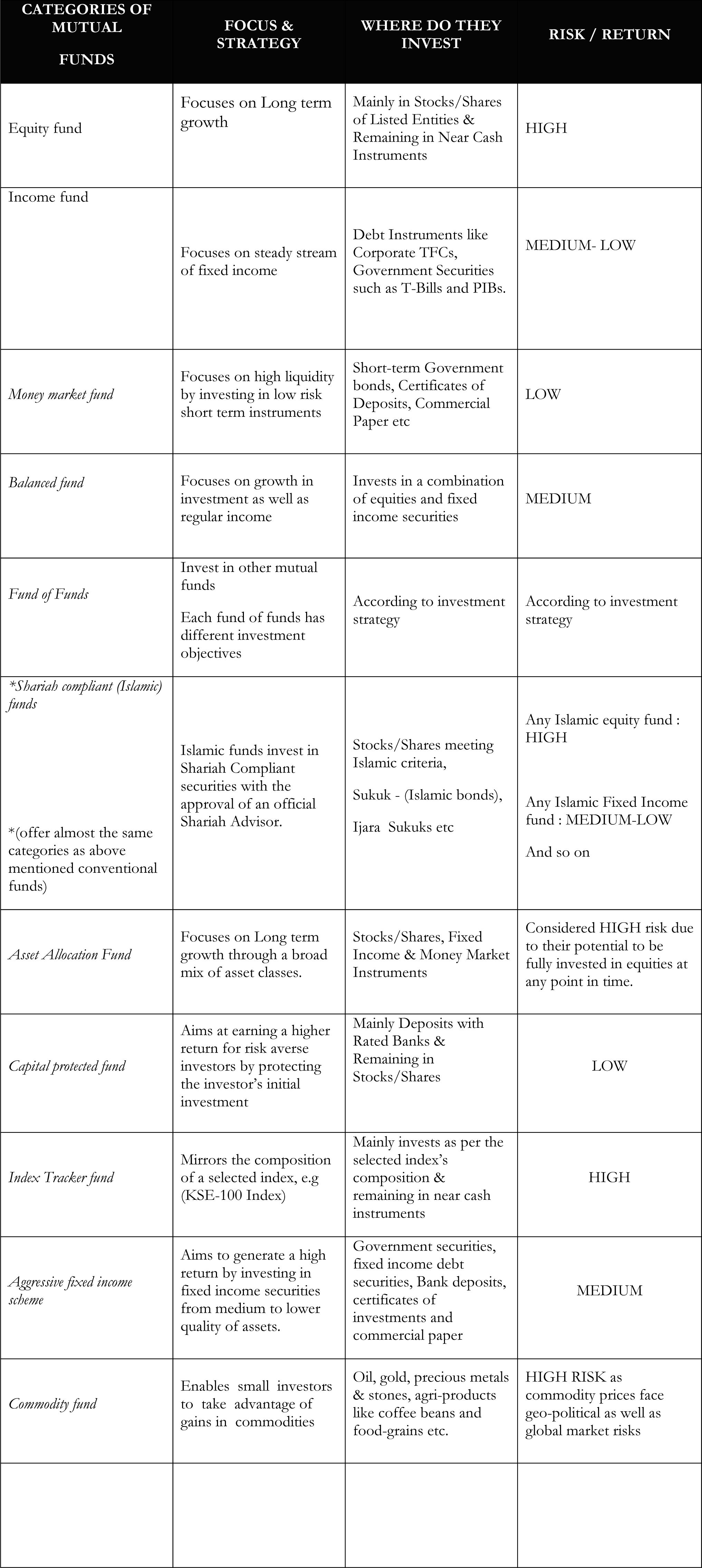

The following table attempts to summarise the different categories of mutual funds available in Pakistan along with their strategies, investment avenues and their risk category:

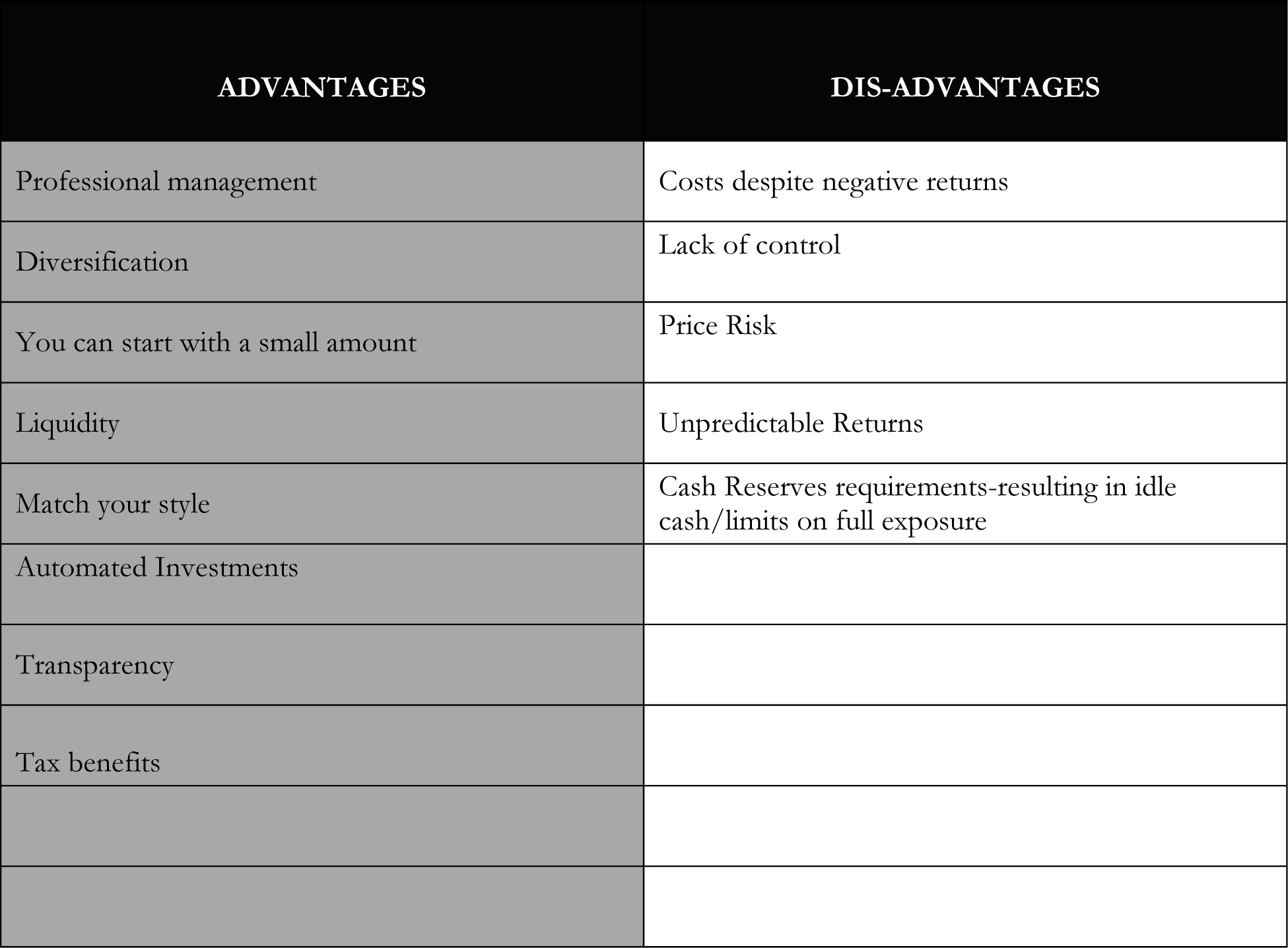

Mutual funds have both pros and cons. There are several factors to take into consideration when deciding to invest in them. We have briefly highlighted these factors in the following table for the ease of our investors:

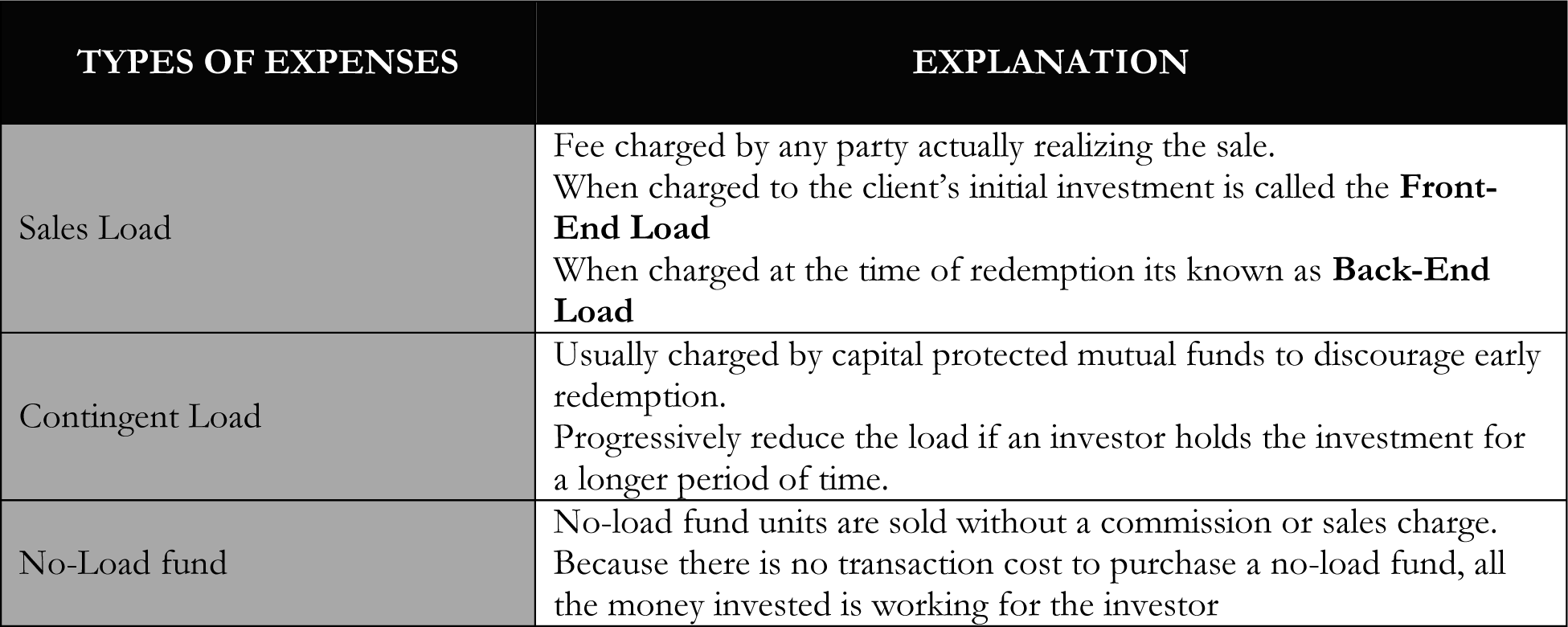

Following are the different fee and expenses charged to the investors in the business of Mutual Funds These are the fees which are usually charged to the investor’s initial investment and the remainder is invested:

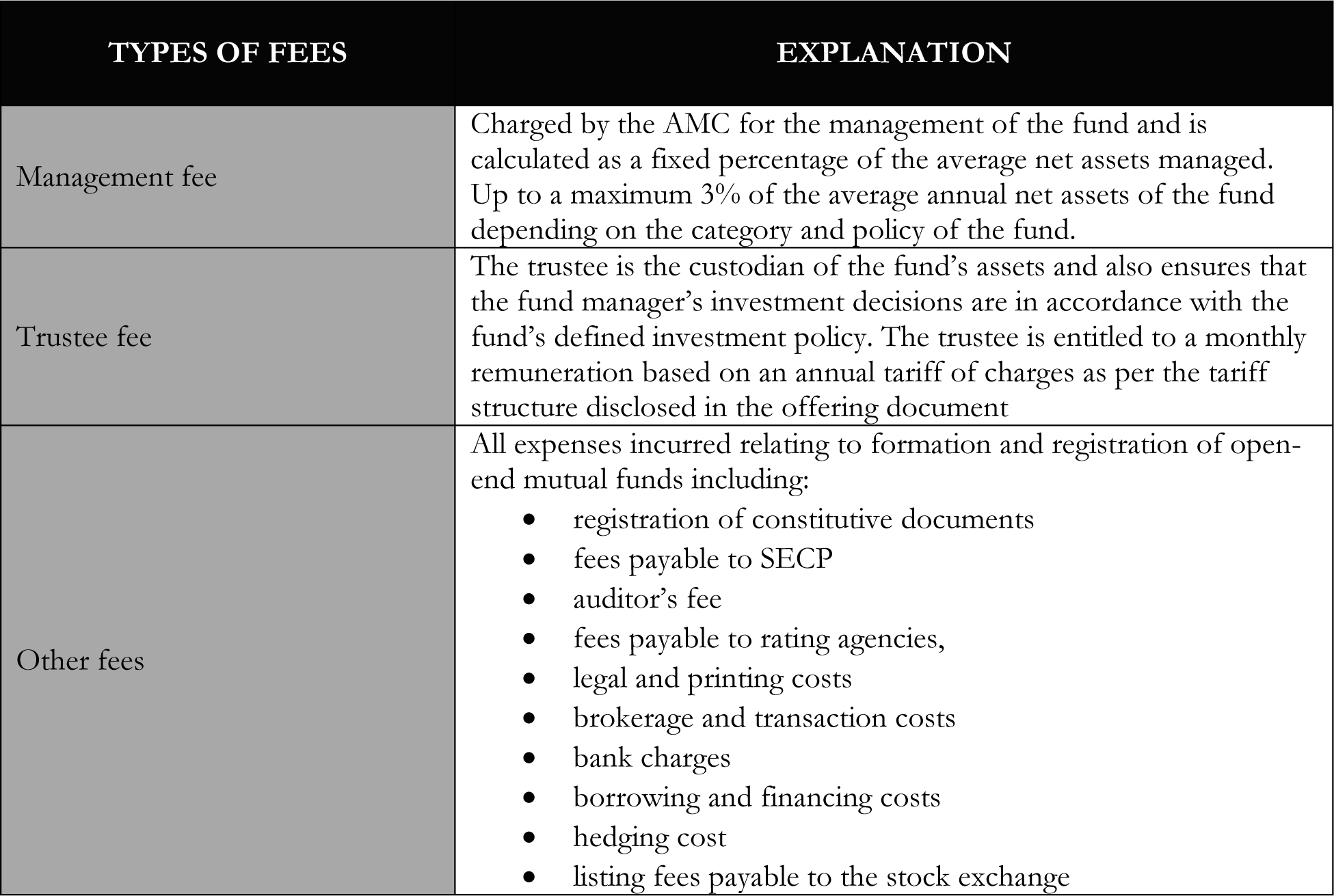

Following are the fees that are charged to the investor’s pool of funds and returns are distributed after deducting these fees

Our Role as Mutual Fund Distributors:

GAAINS Pvt Ltd has the mandate(licence tab reroute) to carry out the business of distributor of Asset Management Companies under clause 3 of Securities & Future Advisers (Licensing & Operations) Regulations 2017.

The concept of mutual funds might be very simple however, investing in them requires an elaborated effort. There are above 250 mutual funds in Pakistan, choosing the one that suits your needs the most could be quite a task. That’s where GAAINS comes in, we aim to provide our clients complete guidance when it comes to investing in Mutual Funds.

Our primary focus will be on the following areas:

To draw the client’s complete financial picture and then select the most appropriate and suitable mutual fund in accordance with his/her risk profile

To perform detailed analysis on key areas of the mutual fund performance based on different risk and return aspects

To carefully select the most efficient and cost-effective funds for our customers. We believe in selecting the funds with not only the highest “on paper” returns but we also strive hard to find the best “return yielding” options for our customers.

Whatsapp Us